Issue #65

Guten Morgen!

There’s been a mighty storm brewing for Europe’s largest sovereign cloud project, Gaia-X. Find out why in our first article, and then jump down to the House’s View to understand how a carbon tax is being used as a geopolitical power instrument. Have a great start into your weekend and happy reading!

Anna Christian

FIRST, SOME SOLID INTEL:

Stormy Weather for Europe’s Sovereign Cloud

On Thursday, Gaia-X, a prominent European initiative to establish a sovereign data ecosystem, launched its yearly main event: the Gaia-X Summit in Milan (and online too of course). Unfortunately, headlines on the event and the whole initiative have focused on controversies and disappointing results. While we always look to tell a story from both sides, there’s really not much positive coverage to highlight.

For background, the initiative is a Franco-German project to bring “digital sovereignty” to European cloud service users by creating an independent, European data infrastructure network. Therefore, when it was revealed that the Summit was being sponsored by companies like Huawei or Alibaba, some senior board members lost their s***. Non-European involvement has been a pain point for the initiative for a while now, as the alliance accepted companies like Microsoft, Google, and the two above Chinese companies as members earlier this year. This created serious divisions. On one hand you have Members who posit that these hyperscalers bring much-needed expertise to the table. On the other hand, you have those who believe these non-European players will water down or hijack the initiative. In fact, recently, similar initiatives like the European Cloud Industrial Alliance (EUCLIDIA) have popped up, positioning themselves as “truly sovereign” in the face of foreign involvement in Gaia-X. And, to make things even worse, French cloud services provider and founding Member Scaleway announced it would be exiting the initiative this week. Its reasoning: slow progress and too much infighting, which it called “a polarization paradox.” And, in a way, the French company is not wrong. Two years after its founding in 2019, we’re still struggling to provide you with concrete examples of progress.

Bitcoin, Dogecoin, Ethereum and… the Euro?

We all know that person who talks way too much about their investments in cryptocurrency and tries to convince others to invest, too. Usual settings for this kind of conversation may include a bar, a restaurant, or…. the European Parliament (EP)? Let me explain: this week, Fabio Panetta, member of the European Central Bank’s (ECB) Executive Board went on a campaign to convince lawmakers a digital euro is absolutely crucial to the future stability of Europe’s financial system. Now while it may sound slightly end-of-days-ish, his (and therefore the ECB’s) reasoning somewhat makes sense.

Panetta’s argument is three-pronged: it’s about stability, control, and opportunity. First, it’s no secret that digital payment methods, including cryptocurrency, are on the rise. The more people that pay with cryptocurrency, a payment form not part of the traditional financial system, the less a regulating authority can do to intervene in the case of instability. Second, according to Panetta, around 70% of European card payment transactions are handled by non-European providers. Whether private companies or decentralized registers are handling the flow of currency, the ECB is unhappy it is not a player in the game. Thirdly, as Panetta stated in the EP, “if we don’t satisfy the demand, then others will do it.” Every time a European citizen uses a third-party digital payment method, it’s an opportunity lost for the ECB.

Seems straightforward enough, so why don’t we get to it? Well, it seems people may not even want a digital Euro. In April 2021, a representative opinion poll showed that only 13% of Germans are in favor. Also, the Commission has not put the topic on next year’s legislative program, due to privacy concerns and other “legal issues.” If something changes, we’ll let you know!

How Mifir becomes My Fear (Yes, We Made That Joke. Deal. With. It.)

We have to note: investing somehow became a trend in lockdown times. Retail brokers, especially those that offer an app for the smartphone experienced a real boom in the pandemic. Many companies skyrocketed their evaluation, received large funding by venture capital and the whole industry was happy. Now, it seems like the EU could ruin the party. This week, we had a look at a leak of the planned update of MiFIR (Markets in Financial Instruments Regulation). The EU Commission seems to plan on a ban of payment for order flow. Why does this matter?

New retail brokers like Robinhood in the US or Trade Republic in Germany attract especially young clients with very low trading fees. This can be done because companies such as Trade Republic sell their order flows to the exchanges they are executed on or to high-frequency traders. German finance experts assessthat half of Trade Republic’s revenue stems from selling the order flows and that it doesn’t look any different for other retail brokers. While payment for order flow keeps trading costs down for individuals, it also has some detriments that you can read about in detail here. The formulation in the leak is still rather vague but it’s a rather silent sensation on this side of the Atlantic. It would question the business model of a whole industry and could potentially end all hopes for profitability by young FinTechs such as Trade Republic. For what it’s worth, Robinhood might be happy now that they haven’t already decided on expanding their business to the EU.

LONG STORY SHORT:

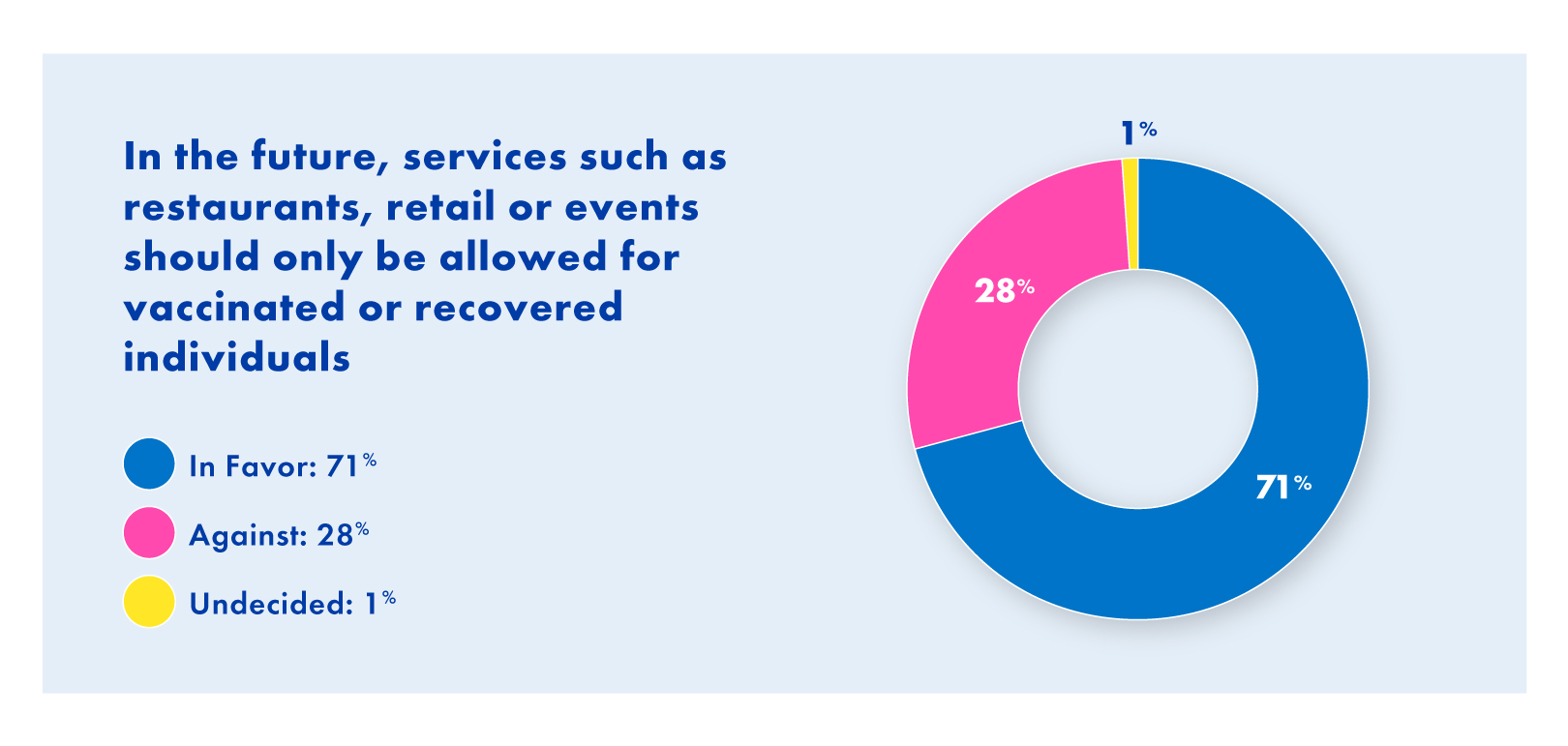

Source: Deutschland Wählt

THE HOUSE’S VIEW:

by Jonny

The Carbon Border Adjustment Mechanism – The EU Showing Off Geopolitical Power

During the COP26 negotiations an EU legislative initiative made some headlines, at least among climate policy interested circles. Here’s why you should care:

What’s the Carbon Border Adjustment Mechanism?

Since quite a few years, the EU has an emission trading system (ETS) in place that sets a price on carbon emission certificates for companies. These certificates only cover certain sectors like heating for instance. Overall, the system seems to be a success as carbon emissions in these sectors have decreased significantly since the introduction.

The Carbon Border Adjustment Mechanism (CBAM) would now set a price on every imported product that is somehow part of the sectors covered by the ETS. For instance, if you import something from the US that used coal energy in its production, you would now pay a tax equivalent to the price of a certificate in the EU. This is a basic explanation, so more exact details can be found here.

The CBAM could possibly start January 1st 2023 with a reporting duty for the carbon rates of imported products. Three years later, the companies would also need to pay the adjustment taxes. The purpose is, of course, preventing EU companies from reallocating carbon-intensive production. This is accompanied by a side effect: companies in non-EU countries will potentially have a hard time selling their products to the EU. Still, for the EU this is logical instrument as it ensures our own climate protection ambitions don’t lead to a competitive disadvantage for our industry. Therefore, the CBAM will also be a priority for the French Presidency of the EU Council starting in January 2022.

What Happened at COP26

EU Commission President von der Leyen pushed ahead with the plans for the CBAM at COP26 in Glasgow. She was of course acknowledging that the perfect solution would be a global agreement on carbon prices between all major industrial states. However, she was also stressing that the EU couldn’t wait any longer, saying “we prefer you keep the money in your economy by putting a price on carbon in your economy”, probably silently adding: “But guess what? YOU DIDN’T, now eat this!”

The Geopolitical Power Instrument

The CBAM is probably – though not even in place yet – a perfect example of how the EU likes to exert geopolitical power. Until recently, Turkey was not part of the Paris Climate Agreement. What changed their minds? According to Ankara’s COP26 negotiator Mehmet Birpinar, apart from a $3.2 billion guarantee from France and Germany to financially support their climate protection ambitions it was mainly the view of the coming CBAM. Around 50% of Turkey’s exports go to EU countries. For Turkey, it is now easier to introduce a carbon price themselves with their soon-to-be-released climate protection law. Keeping the money on carbon in their own economy is better than (indirectly) paying it to the EU. Suddenly, climate protection just seems like the sensible thing to do (and for sure the $3.2 billion financial support might have been an argument as well).

What can this form of geopolitical power bring besides confrontation? Besides the willingness to solve the tariff conflict around steel and aluminum, the EU and US agreed on plans to reduce the emissions in this sector at the same time. Finding common reduction targets here in the form of a so-called “climate club” would ensure that US exports of steel or aluminum to the EU are not hit by the CBAM if common standards in the production are met.

The House’s View

It should be clear that the EU doesn’t follow this approach out of the goodness of their hearts. It ensures that our supply chains can work in the future, that global migration pressure on the EU isn’t increasing (which happens when climate change continues) and that our industry gets protected. Still, the last days showed that the EU’s largest form of power is still the world’s biggest single market. You probably remember that from the GDPR or the analyses of how the EU exercises legislative power in the wonderful book “The Brussels Effect” by Columbia Law School professor Anu Bradford. We believe this very practical instrument might influence many processes in global climate protection policy over the next decades. Ping us, if you want to know what other EU climate policies might shape your business in the future.

LONG STORY SHORT:

- Calling all Digital Programs: This week, the European Commission announced a first set of calls for proposals under the “Digital Europe Program” aiming to advance the digital transition. Just FYI, there’s about €2 billion up for grabs.

- Immunity isn’t Only for COVID: On Thursday, former Austrian Chancellor Sebastian Kurz had his immunity lifted by the parliament, meaning he’s now fair game for corruption investigations. He remains convinced the claims against him are false.

- Nord Stream 2: the Wait Continues: On Tuesday, German regulators decided to suspend licensing of the Nord Stream 2 natural gas pipeline from Russia to Germany. This decision likely means licensing of the pipeline won’t occur until March 2022, and gas prices surged in the wake of the decision.

WHAT’S ON OUR MINDS

A CHANCELLOR FOR ST. NICK’S

The question I got asked most in DC was: When will Germany have a new Government?

And my answer was…

We had elections end of September, shortly after, the Social Democrats, the Liberals and the Greens agreed to enter negotiations to form the so called “Traffic Light” coalition*. They set themselves an ambitious timeline:

- working groups develop different topics till mid-November

- the parties’ leadership finalize the coalition treaty till end-November

- the parties approve the treaty

- the coalition MPs elect the new chancellor almost in time for St. Nick’s (second week of December)

So far, all according to plan. The working groups delivered their reports on their respective topics, now it is up to the parties’ leadership to finalize and find consensus on the remaining open questions.

Except…the working groups kind of focused on the easy questions, they agreed on Cannabis legalization, more digitization, less bureaucracy, and a sugar tax.

What they seemed to have not answered are the tough questions, the potential deal breakers. Questions like tax raises, costly climate change programs, foreign policy; topics where the parties’ lines seem to be fundamentally irreconcilable. I would be very surprised, if all of this got resolved in the same quiet and unexcited way the coalition negotiations have been conducted so far. Or even if all this gets resolved at all.

But maybe they have it all figured out already and just continue to be the most clandestine negotiators the republic has ever seen.

*traffic lights coalition, because we give colors to each party: Social Democrats = red, Liberals = yellow, Green = green, duh