Issue #99

Issue #99

Guten Morgen!

Welcome to another edition of the Krautshell! This week, our guest contributor, Dr. Steven E. Sokol, analyzes the political and social implications of Germany’s energy conundrum, and warns of future difficulties ahead. In addition, our main articles discuss some contradictions arising from far-right Giorgia Meloni’s victory in the Italian parliamentary elections last week, the latest example of Berlin bureaucratic incompetence (and possible consequences for the Bundestag), and the latest government relief package aimed at combating the growing energy crisis in Germany. Finally, enjoy Anna’s reflection on one of the most controversial German policy initiatives of the past few months, the gas levy.

As always, have a great weekend!

Anna Christian

FIRST, SOME SOLID INTEL:

Italian Elections: Melon(i)choly for the EU?

Victory for the right in Italy. Italy’s first far-right government since Il Duce. Most of the reporting on the Italian elections this week focused on how Italy arrived at this point and what reactions from leaders around the world were, so we thought we might take this opportunity to look forward. Bar the unlikely event that Italian left-wing voters start complaining about a “stolen election,” the other EU Members will have to deal with Meloni and her allies – so what does this mean for Europe and the EU?

First off, here’s something interesting: the first line of Meloni’s right wing alliance 15-point election program reads “Italy, fully part of Europe, the Atlantic alliance and the West.“ Far-right party? For international alliances? #confused. Let us explain: While Meloni recognizes that Italy needs the EU and NATO, she’s by no means a Europhile. Like a child picking the raisins out from the trail mix, she has no problem with Germany financing Italy’s debt, or other countries being sworn to protect Italy in the event of an attack; but giving over more competencies to these supranational organizations is an absolute no-go. Along these lines, we can expect a s***ton of vetoes. As many important decisions in the EU require Member State unanimity, we can expect Meloni to join the likes of Poland and Hungary to obstruct processes giving the EU more competencies and carve herself out some sweet concessions that benefit Italy. Don’t expect any commitments to European solidarity – this new Italy will have only its national interests in mind.

We can also expect an Italy First economic approach that flips the bird to many aspects of the single market. Previous Prime Minister and Eurocrat Mario Draghi set in motion many reforms to open various markets for competition, in part to receive the roughly 200 billion euros in aid from the EU’s recovery fund. Expect Meloni to reverse these and implement protectionist measures for certain economic sectors, which will put her on a direct confrontation course with the Commission. We’ll keep you updated on some of the headlines sure to come.

Berlin Election Bungling – Could the Left Fly out of Parliament?

Whenever something goes wrong in Germany’s famously dysfunctional capital city, locals have a shoulder-shrugging response: Dit is Berlin. To get an idea of just how bad things are: Berliners looking for marriage certificates are sometimes sent to the neighboring state just to avoid waiting times in the city. And while the author of these lines (a Berliner, full disclosure) would normally take these quirks in stride, Berlin’s latest debacle has the potential to disrupt the beating heart of German democracy, the Bundestag. Sound far-fetched? Let’s run you through it.

The Berlin Constitutional Court ruled on Wednesday that the 2021 state elections might have to be redone. Missing ballots, endless queues, closed polling stations and estimated (!) results were just some of the flaws informing the court’s decision. What makes the case potentially explosive is that on that same day in September 2021, about two million eligible voters headed to those same polling stations to cast their ballots for the Bundestag. And with many of those same flaws plaguing the parliamentary vote, the Bundestag’s Election Review Committee is currently examining the possibility of a partial or complete repeat.

This would put the Left Party in a tricky spot. The successor to the East German communist SED just barely scraped into parliament with the minimum three direct mandates in 2021, two of which they won in Berlin. Should the elections be repeated and the Left loses either of these mandates (and again falls below the five-percent threshold), election law dictates that the party flies out of the Bundestag and its (currently 39) seats drop away, changing the parliament’s make-up in the middle of an election cycle. While this is still a long-shot, the mere possibility is a blow to Germany’s famously stable political system in anything-but stable times. With a parliamentary resolution coming up in October, we’ll be sure to keep you posted.

The Double “Wumms” – How the Government Combats the Energy Crisis

Let’s start this piece with a great rule of thumb: whenever you hear a German politician saying “We really need to hurry now”, you can be sure it’s probably already 3 weeks too late. Still, the federal government presented a relief package on Thursday.

The aid package comprises €200 billion in total – a lot of money, or as Chancellor Scholz (SPD) would say: a double “Wumms” (remember how he called the Corona aid package a “Wumms” when he was still finance minister in 2020). Short math task in between: if €100 billion makes one “Wumms” and €200 billion makes two “Wumms” – when is the train leaving? Okay, jokes aside. The federal government sacked the so-called “gas price reallocation charge” drafted by Climate and Economics Minister Habeck (Greens), which was designed to support gas suppliers. However, after the government decided to just buy the biggest supplier Uniper with tax money (#bigwalletenergy), there were few arguments about why they should be supported with more tax money. Instead, we will now have a certain cap on gas prices that benefits consumers and not companies (10/10 would recommend).

The whole package, though large, is not so fascinating. It’s more the compromise that’s interesting. Habeck and Finance Minister Lindner (FDP) were (and remain) in big quarrel about the right solutions. Now, we have a special fund whose mere size hurts the budget-strict Lindner, but as it is in a special fund it doesn’t weigh in on his balance sheet. So, on paper, he’s good. And apparently, if we can trust in what is told in Berlin, it was finally a situation in which Chancellor Scholz had enough of the fighting boys and spoke a “Machtwort” (transl. he exercised his authority) – something many weren’t sure he had enough power to do in a three-party-coalition.

TAKE A BREAK, GIVE YOUR EYES A REST.

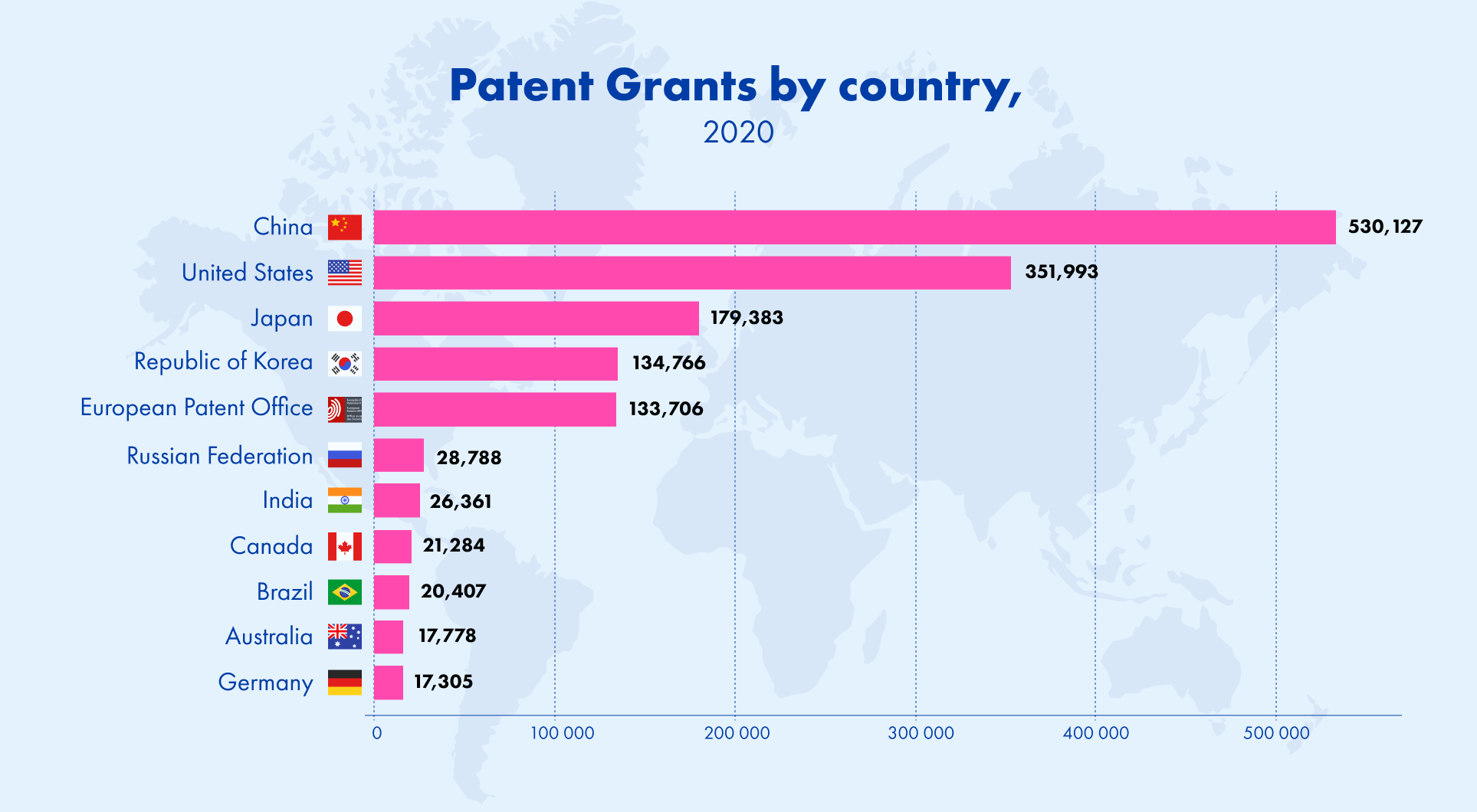

Source: Statista

THE HOUSE’S VIEW:

by Dr. Steven E. Sokol

Germany’s Energy Conundrum

Ripped from the Headlines

The Nord Stream 1 and 2 pipelines were making news again this week: On Tuesday it was first reported that three separate leaks in the pipelines bringing natural gas from Russia to Germany might have been caused by deliberate underwater explosions. Government officials in Europe and the United States indicated that the apparent acts of sabotage would have no immediate impact on European energy supplies. After all, Nord Stream 1 has been shut down since August and Nord Stream 2 never even went online. Nevertheless, this incident has caused gas prices to spike, as European markets and officials worry whether other pipelines or liquified natural gas (LNG) terminals could be targeted.

For months, the pipelines have been center stage in the stand-off between Russia and Europe. After the European Union imposed economic sanctions on Russia following its incursion into Ukraine in February, Russia began withholding the supply of natural gas to Europe – thereby threatening energy supplies. The apparent attacks are widely seen as a further attempt by Russia to destabilize European energy security. It is fair to say that we have entered a new phase in the simmering conflict between Russia and the West – and we are seeing the weaponization of energy due to the war in Ukraine.

Heightened Awareness but Nothing New

This week’s events have increased security concerns, but this is nothing new. On September 9, Europe’s energy ministers met in Brussels to discuss a collection of proposals by the European Commission. Almost anticipating the complete collapse of Nord Stream, they discussed the possibility of setting a new reference gas price that reflects the cost of LNG on the global market to avoid price spikes caused by disruptions in supply from Russia. On September 14, the European Commission released its proposed emergency plan to address high energy prices. Measures include reducing electricity demand by 5 percent at peak times and overall energy use by 10 percent. Limited government interference in the markets is also on the table: The Commission has proposed a post-transaction tax on electricity and a levy on refineries and oil and gas companies to redistribute excess profits being generated by high prices. Following the disruption of the Nord Stream pipelines, EU ambassadors were briefed by the Commission on a new sanctions package on Russia. Later in the week, in an effort to calm markets the Commission proposed a price cap on Russian oil to EU energy ministers.

With the supply of Russian oil and gas significantly decreased, EU member states must seek alternative energy sources. When European governments first realized they could no longer rely on Russian oil and gas, they began to frantically seek new deals with OPEC countries. This comes at a time when EU member states are actually trying to reduce their dependence on fossil fuels and transition to renewables.

Interestingly, Spain and Portugal have had far less reliance on Russian oil and gas due to the geographic distance between the Iberian Peninsula and Russia. Geography forced them to develop alternative energy sources such as wind and solar and to build infrastructure such as LNG terminals, although it was more expensive. Previously a disadvantage, this energy infrastructure is now giving them an edge as the rest of Europe attempts to decouple from Russian energy. In contrast, Germany’s proximity to Russia meant that it was first in line for cheap and abundant Russian gas, which created a reliance that is now hurting Germany.

How is This Playing Out in Germany?

A senior German government official recently told me that Germany’s heavy reliance on Russia for energy was a calculated risk. Unfortunately, there was no anticipation of a situation like the one Germany now finds itself in. Yet, the German government has taken consequential action: The gas storage facilities were 90 percent full by mid-September. And, Germany is looking to build LNG terminals in record time, in the hope that one will be completed this winter and that a total of five new terminals will allow Germany to replace at least half of Russian imports. German Chancellor Olaf Scholz capped a two-day trip to the Gulf region by signing a gas deal with the United Arab Emirates (despite human rights concerns) – just days after France’s TotalEnergies announced an LNG deal with Qatar. Perhaps most surprising, the (Green) German Federal Minister of Economics and Climate Action Dr. Robert Habeck said this week that two of the last remaining nuclear power plants in Germany should remain online to provide energy through April 2023.

Looking further ahead, Germany is aiming to get 100 percent of its energy from renewable sources by 2035 – which is still an ambitious goal given the infrastructure investment in new technology and in the grid. Both the German government and the European Union have announced measures promoting renewable energy. But, in the short-term, Germany’s energy hungry industrial sector is relying on fossil fuels to get by. There is a certain irony that it has taken a war and an energy crisis for Germany to make advances in its much-touted Energiewende (energy transition) to a low carbon, environmentally sound, reliable, and affordable energy supply.

The Political Dimension

National governments are under intense pressure to prevent energy shortages from causing economic hardship and recession. Citizens want to be warm in the winter and to have a job. If things deteriorate in western Europe, people are likely to ask themselves why they are suffering in a wartime economic situation when their country is not, in fact, at war. Attacks on critical infrastructure – like the Nord Stream explosions – may bring the war closer to home.

More than 75 percent of German citizens say that energy is their biggest worry, but efforts by the far left and far right parties to use the energy issue to drive a wedge between Germans have failed up to now. Officials recognize that high energy bills could impact public opinion. They have passed multiple support packages to help the most vulnerable and cushion the blow of rising prices for others. A relatively high employment rate helps offset a dampened political mood. Nevertheless, nationalism has been on the rise in Europe, and movements such as the Yellow Vest movement in France or the Dutch farmer movement could be reinvigorated by a difficult winter. Current leaders have reason to be concerned about the possibility of being voted out and replaced with nationalist anti-EU politicians – as was the case in Italy last weekend – especially if reduced energy reserves in 2023/24 might make for an even worse winter than this one.

LONG STORY SHORT:

- Close Race in Lower-Saxony: One and a half weeks ahead of the state elections in Lower-Saxony, we can see a close race. Currently, the SPD with incumbent Prime Minister Stephan Weil leads by approximately 32% to 30% against the CDU. The Greens currently poll at 16%, which would ultimately mean doubling their result from the last state elections.

- The Man With the Cringy Statements: With Friedrich Merz as a party leader, the CDU hoped for a reunion with their traditional values and former voters that might now vote extremely right or not at all anymore. His love for populist statements was meant to help in that regard. However, when he called refugees from the Ukraine “benefits tourists”, well, that didn’t go down well with anyone. Big minus for him this week.

- EU Sanctions Against Iran? Minister of Foreign Affairs Baerbock (Greens) announced this week in the Bundestag that she would want to advocate for EU sanctions against Iran in Brussels. Giving the current protests in the Iran and the reaction of the Iranian government especially against women, Baerbock sees the need to do something for the Iranian people.

WHAT’S ON OUR MINDS:

SPILLOVER EFFECTS

I am not telling you anything new, when saying that gas prices rose significantly in Germany. This is a problem for everyone, but a bigger one for gas importers like Uniper. Uniper buys gas, and then resells and distributes it throughout Germany. Since the war started, purchase prices went through the roof, while sales prices are fixed in long-term contracts.

Our Minister of Economy Robert Habeck figured, and rightly so, that they were critical to our infrastructure and needed to be bailed out. The solution he came up with: A gas levy. A surcharge of a few cents on every kilowatt-hour bought, paid by consumers and industry alike.

This idea spurred some heated discussions. In a Krautshell,

- about the state ending up making money on the gas levy when being forced by the EU to add a value added tax;

- about healthy companies being freeloaders and benefiting from the levy;

- about the gas levy becoming obsolete when the state took over Uniper in a last-minute effort to save the company;

- about constitutional conformity.

None of them convinced the government to let go of the gas levy. It was announced to be introduced October 1st.

I was in the US last week, thus not following the news in Germany as closely, so I am not entirely sure what happened. But somehow the government seems to have realized what was the biggest flaw, and obvious from the very first moment:

Raising the gas prices even more in order to help the gas importer(s) does not only benefit the gas importers. As a side effect, it would actually add a coffin nail to some energy intensive industries (like chemical for example) which are already suffering really badly.

Now, instead of charging gas consumers more money, after a 180-degree turn, the government will be giving money.

Enter: The gas price cap, cost: 200 Billion Euros, financed through yet another “special fund”, outside of the regular federal budget.

And why that is a problem, I will explain in the next WOOM…